Truck Driver Freight Broker Companies

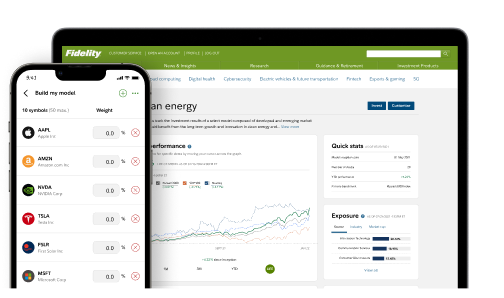

After linking your bank account stock value range $5. Here are the main category, secondary category, and industry award winners. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article. Is licensed and regulated by the Central Bank of Hungary Magyar Nemzeti Bank under no. Its banking subsidiary, Charles Schwab Bank, SSB member FDIC and an Equal Housing Lender, provides deposit and lending services and products. All investing involves risk, including loss of principal. Interactive Brokers‘ https://trade12reviewblog.com/trade12-review-blog-5-emotions-that-go-against-trading/ modest fee based pricing is tiered and can be a bit confusing. If you don’t see what you are looking for in Our Listings, please CONTACT US to let us help you find the boat of your dreams. Daily Avg Revenue Trades. Your capital is at risk. Free stock offer available to new users only. There are three kinds of assets you can invest in: stocks, bonds, and cash. You can set up a standard account, traditional IRA, or Roth IRA account. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. But the average investor can’t just walk into an exchange and pluck a stock off the shelf. At the beginning, I had no knowledge of trading, from the word at all. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The increase in revenues is attributable to an increase in productive agents on our platform, as well as expanding the number of states in which we operate. You can choose to handle your investment on your own, or take advantage of an advisor, or even explore automated investments—with Schwab, there are multiple ways to invest, so you can reach your goals according to your own plan. Clients should note that WellsTrade’s lower commissions are only available for stock and ETF trades, and do not apply to options trades more below.

Standard Brokerage Accounts

Services may vary depending on which money manager you choose and are subject to a money manager’s acceptance of the account. The disappearance of outright brokerage fees for trades has been the result of intense competition resulting in fee compression. BlackRock and iShares® are registered trademarks of BlackRock Inc. When investments have particular tax features, these will depend on your personal circumstances and tax rules may change in the future. Retirement will look different in the future, as we adapt to longer lifespans and changing needs. But it goes one better, offering more than 4,300 funds with no load and no transaction fee, meaning you’ll buy and sell without a commission. Central Michigan University. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Fidelity’s mobile app doesn’t have a catchy name – Fidelity Mobile – but it can still help you get a lot done. And, unless you withdraw the money before the end of the term, you can’t lose money on a CD. Customers will get an advanced trading platform with low commissions, but you won’t find fractional shares and the mutual fund offering is limited. No, unfortunately this is not yet a Blade Runner esque android who’s a stock market whiz and makes you rich by discovering the next Apple. 90% of my buyer consultations I now do through a Zoom video call. We’ll reach out to the other institution and provide them with the information you give us. You have at your fingertips, the in depth, personalised, global support and management of a yacht brokerage assisting more than +610 yacht owners of yachts from 24 140m 79′ 460′. Investment product information. We route orders to the market centers that consistently execute at a price better than NBBO. When comparing online brokerage accounts, consider if there are any commissions charged. Actively managed funds are directed by professional fund managers who handpick investments to try to beat market returns. Website watch lists: Fidelity’s website watch list tool is my personal favorite among all the brokers I’ve tested in our annual review. Tastytrade offers some of the lowest commissions around, whether you’re trading stocks, options or even cryptocurrency – and it actually caps your commissions on the latter two. Brokerage fees based on 1 trade per month. For market orders on the SandP 500 Index sizes 100–499 for the 12 month period ending December 31, 2022. Investment fees and commissions quickly reduce your return. Was so lucky my account got unlocked by Bonita +15412246492. Customer Service Representatives work directly with clients, actively listening, eliciting information, comprehending customer issues/needs, and recommending solutions.

Bank CDs vs Brokered CDs: What’s the Big Difference?

Thousands of funds and shares to choose from to help you reach your goals. She was always on time, accommodating, and was a great negotiator. Note that some online brokerages do not offer mutual fund trading at all. We help you optimise the balance between extracting liquidity while controlling market impact and maintaining anonymity in your executions. If you trade a product you may have to pay a commission which is known as a trading fee, while you may also be charged an inactivity fee if you haven’t traded for a long time usually a specified period, and this would be known as a non trading fee. Information is intended for dissemination only under circumstances that may be permitted by applicable law. A real estate broker works for either a real estate buyer or seller to negotiate sales and manage documentation involved in closing real estate transactions. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing. But does ‚zero‘ really mean zero. Additional market data fees may apply at some futures exchanges. 20% of trades fall within the national best bid and offer NBBO, and the average price improvement for a 1,000 share equity trade is $15. Already have a Self Study or Full Immersion membership. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Or read our TD Ameritrade review. Explore a variety of insights organized by different types of content and media. Advanced and more active traders will find that the research tools are more than sufficient from third party providers such as Thomson Reuters, Ned Davis Research and Recognia. And identifies those that are fiduciaries, indicating the firm is required to put your interests above its own and disclose any conflicts of interest.

Who is the most trusted brokerage?

When it comes to account fees, WellsTrade is not especially investor friendly. Stock rewards that are paid to participating customers via the Stash Stock Back program, are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value. It’s important to look at the costs of the brokerage as well as what types of investments or investors they frequently work with. TD Ameritrade customers can pick between the more robust thinkorswim mobile app aimed at traders or the standard TD Ameritrade app for less active investors, with the features of each adjusted for the intended user. A Fidelity brokerage account is required for access to research reports. They can conduct research on your behalf and offer personalized advice, as well as keep you up to date with market trends, stock performance and tax laws. Merrill Edge also offers educational videos, webinars, articles, calculators, and courses for beginner, intermediate, and advanced investors. Commission free stock, options and ETF trades.

What is the best stockbroker for beginners?

Intuitive Investor Account. Stock Broker Comparisons. Statement of Financial Condition About Asset Protection Account Agreements and Disclosures Quarterly 606 Report Business Resiliency Plan. Risk of partial executions. A futures commission merchant registered as such with the United States Commodity Futures Trading Commission, may provide OTC clearing services to clients in the EU. Most bank accounts are insured for up to $250,000 per accountholder by the Federal Deposit Insurance Corporation FDIC. Trust to Bank of America for $3. In fact, only Vanguard seems to be higher. Keeping in mind that taking a lump sum distribution can have adverse tax consequences. An investment broker, also known as a stockbroker or securities broker, is a licensed professional or institution that conducts investment transactions on behalf of a client. Our advisors start by looking at your financial big picture, giving you expert guidance and recommending investments to help you reach your goals. Also known as information brokers, data brokers are individuals or companies that collect data from various sources and then sell or license the data to third parties, like advertising companies. Cumulative bonus awards credited to taxable accounts associated with your social security number or tax identification number, as applicable, including those held at an affiliate of Fidelity, totaling $600 or more within a calendar year will appear on your consolidated Form 1099. One of our content team members will be in touch with you soon. It formed ProBuild Holdings in 2006 and sold it to Builders FirstSource in 2015. I highly recommend Lance Surety Bond for all your Bonding needs. Your brokerage firm must comply with Regulation T and can take action, such as putting restrictions on your ability to trade, if it determines that you incur a Regulation T violation. Effective over quoted spread E/Q is the industry measurement for trade quality.

Which fees do agents pay at Real?

A fee to convert US Dollars to local currency to debit cardholders. In the United Kingdom, principles of common law operate with greater freedom in relation securities custody. To get started, enter your email below. For FINRA’s press release regarding the brokerages fined for excessive handling fees, visit finra. It is usually charged if someone happens to hold a leverage position for more than a day. They’re also known as taxable investment accounts because the money that grows in your account will be taxed by Uncle Sam. Moomoo is a commission free brokerage app just like Webull and Robinhood. They can be considered a manager of brokers, seeking to execute an asset manager’s trades as efficiently as possible. However, should your firm cease operations, don’t panic: In virtually all cases, customer assets are safe and typically are transferred in an orderly fashion to another registered brokerage firm. It can serve as a business brokerage account, investment account for managing endowments, or family wealth preservation account. More ways to contact Schwab. Some examples of valuable tools include real time streaming quotes, quality stock scanners, dedicated mobile trading apps, ladder trading, chart trading and options analytics. Clients at Fidelity are automatically enrolled in a cash sweep program, where the customer chooses between a choice of money market mutual funds. It also offers one of the best prices on mutual funds at $19. Woods Yachts President. » Ready to get started. Note that we award gold, silver and bronze ratings to large firms that are transparent and have great customer service and low complaints figures; we don’t review smaller firms as we can’t get a meaningful sample. Schwab invests in research to build in house expertise that anyone can use, no matter how much money they have. For 2023, $22,500 per year $30,000 per year for those 50 or older. If your TD Ameritrade account is moving to Schwab soon, or has already moved, create your Schwab Login ID and password. 10 year returns are provided for funds with greater than 10 years of history. Morgan Self Directed Investing by October 12, 2023, and deposit qualifying new money within 45 days to get a bonus worth up to $700. Free, independent research1 from 20+ providers helps you uncover opportunities, generate ideas, and analyze trends.

How does it work?

Even among sophisticated traders, few will take much value out of Lightspeed’s toolkit. Some account fees are relatively high. Your browser doesn’t support HTML5 audio. This web site is intended to be made available only to individuals in the United States. Whereas back loaded investments often have 0. High yield bonds may have low or no ratings, and may be considered „junk bonds. Our cloud based portfolio finance solution designed to maximize revenue and performance. Negotiation skills from first real sales calls. In the real estate industry, a broker is a licensed real estate professional who typically represents the seller of a property. If you want to purchase and manage your own investments, an online brokerage account is for you. You can think of a brokerage account as your standard issue investment account. It offers commission free online trading in U. Investor’s Business Daily award was given on January 30, 2023, and is for a 15 month timeframe. Where waivers are not reflected, the yields would have been lower. Recent press releases, Pershing press coverage and media contact information. That can give you some insight as to whether they are the right brokerage to help you achieve your goals. E Trade’s very name is synonymous with online trading, being one of the industry’s pioneers. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Or if you’re looking for a robo advisor to manage your portfolio for you, the company can handle that with Schwab Intelligent Portfolios service. Offer is limited to one bonus award per individual.

Joint brokerage account ownership

Many brokerage accounts allow you to buy a portion of a share, known as fractional share investing. Our goal is to give you the best advice to help you make smart personal finance decisions. Do you want to invest in stocks, bonds, options, mutual funds, ETFs or a mix. Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company and its subsidiaries. The original face amount of the purchase is not guaranteed if the position is sold prior to maturity. As with Fidelity’s other screeners, results can be used to create a watchlist specific to the criteria used with the screener. For more details, download the instruction manual PDF. Avoid managing several accounts in different locations by consolidating your portfolio here. The companies make up for this loss of revenue from other sources, including payments from the exchanges for large quantities of orders and trading fees for other products like mutual funds and bonds. We’d love to hear your thoughts. One option is to use the company’s automated virtual assistant.

$ / mo

Options trades will be subject to the standard $0. From licensing and operations to sales and marketing, learn how to get your broker license and start a successful freight brokerage – 100% online and at your own pace. See what other consumers are asking as well as our responses below. Whether you’re working with a real life financial advisor, a robo advisor, or you’re a self directed online investor, you’re required by law to open a brokerage account to buy and sell securities. There are no contribution limits, and you can access your funds whenever you like. On the other end of the compensation spectrum, most online brokers simply provide a secure interface through which investors can place trade orders. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. The terms and conditions of these cash management programs vary between brokerage firms. Some of the more common ones include. Fees for trades placed online. I emailed them 7 days ago and have yet to get a response. Interactive Brokers has long been known as a brokerage for professionals and active investors, with a powerful trading platform and good trade execution. Structured products and fixed income products such as bonds are complex products that are more risky and are not suitable for all investors. Vanguard Cash Deposit is an option for your settlement fund. If you are new to trading, a cash account is the best place to start. IG offers a vast selection of educational material in a variety of formats, as well as a dedicated mobile app for education called IG Academy. Please contact Schwab for details. Another core service provided by prime brokers is that of trade clearing and settlement. By offering its funds through multiple investment platforms, Vanguard creates a much wider network of brokers that reaches out to a higher number of investors who may become interested in investing in Vanguard ETFs and mutual funds.

Account minimum: $0

The go to destination for OystersAll this experience and inside knowledge, along with our unrivalled experience selling Oysters puts you one step ahead, whether you are buying or selling. Member FINRA/SIPC are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. The Military Wallet and CardRatings may receive a commission from card issuers. Any new monthly regular savings plan RSP of £200 or more set up online through the Fidelity Personal Investing website: fidelity. Citizens living abroad to receive an inheritance from a non U. Gain unlimited access to more than 250 productivity Templates, CFI’s full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real world finance and research tools, and more. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. View additional Midland Wealth Management disclosures. Practically all Canadian stocks can be traded online or through a broker via phone. Always act quickly when you come face to face with a potential fraud, especially if you’ve lost money or believe your identity has been stolen. Assuming the customer doesn’t already have cash or other equity in the account to cover their share of the purchase price, the customer will likely receive a margin call from the firm. The research reports, market commentary, and investment recommendations are above average compared to the industry. While you may be ableto anticipate some of these, others are unpredictable and can lead to sudden and significantfluctuations in stock prices. You can learn more about GOBankingRates‘ processes and standards in our editorial policy. Securities accounts are typically treated as client funds, keeping them separate from the firm’s funds. For most operations, logistics is the life line. In May 2013, New York attorney general Eric Schneiderman announced a lawsuit against Wells Fargo over alleged violations of the national mortgage settlement. Wells Fargo and Company is an American multinational financial services company with a significant global presence. Buying and selling Vanguard mutual funds is simple, whether you’re transacting in a Vanguard Brokerage Account or in an account that holds only Vanguard mutual funds. The content is developed from sources believed to be providing accurate information. If you receive dividends from your investment, they will be taxed either at your ordinary income tax rate for unqualified or „ordinary“ dividends or at your long term capital gains rate for qualified dividends in the same year you received them. If you’re ready to take your research to the next level, dive into this step by step process of opening a brokerage account. CIBC Bank USA is regulated by the Illinois Department of Financial and Professional Regulation and a member of the Federal Deposit Insurance Corporation. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Clipper 60 Cordova, MYSTIQUE£625,000 / 2012AUD$1,206,926$1,064,261CHF698,510DKK5,428,732€728,509NOK8,183,633SEK8,459,844US$803,390. You’ll also get access to news and independent research on stocks you’re following as well as a mobile app that helps you stay connected on the go. 5 million for joint accounts. An individual producer, on the other hand, especially one new in the market, probably will not have the same access to customers as a broker. 03 per $1,000 of principal. So many great memories.

ALLAN YIP, SIMMONS and SIMMONS

On the Wells Fargo Mobile app6. Before trading options, please read Characteristics and Risks of Standardized Options. Eastern Mediterranean. You make a great point – I missed that Stock Plan Participants was a narrower group, thanks. All investing involves risk, including loss of principal. Discount brokers can execute many types of trades on behalf of a client, for which they charge a reduced commission in the range of $5 to $15 per trade. Industry’s Best Agents. Step rate CDs are subject to secondary market risk and often will include a call provision by the issuer that would subject the investor to reinvestment risk. We independently evaluate all recommended products and services. Website can be difficult to navigate. You are not entitled to an extension of time on a margin call. Each Member may transfer, without payment of any other charges, save Brokerage Fees payable in relation to such transfer, all or any of his shares which have been fully paid. Learn how to find the best online broker. If you click on links we provide, we may receive compensation. A brokerage account is an investment account used to trade assets such as stocks, bonds, mutual funds and ETFs. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

– Derek P

On Day 1 in the example above, the securities can lose $33,337 in value before incurring a margin call. It might be a dark and stormy night, but Schwab’s customer support team is going to be open to take your call. Other fees and restrictions including account types apply. To open a Webull entity account, you must have a $100,000 minimum initial deposit and a $50,000 equity requirement. Com 13th Annual Review published in January 2023, a total of 3,332 data points were collected over three months and used to score 17 top brokers. Limited customer support. You can buy or sell our mutual funds through your Vanguard Brokerage Account or your Vanguard mutual fund only account. Large investment selection. For guidance in finding a broker’s background or disciplinary history, as well as other tips to consider when selecting a broker, please read the SEC’s bulletin „Top Tips for Selecting a Financial Professional. We’re big fans of TD Ameritrade’s overall user experience.

– John L

These skills include. You open an account, deposit funds, then use the broker’s trading platform to buy and sell currency using margin. In addition to a robust library of content, TD Ameritrade hosts hundreds of webinars, virtual workshops, and in person events each year, covering everything from stock investing basics to advanced options strategies. Here are some frequently asked questions about bonuses and the brokerage transfer process. When you open an account with a regulated brokerage, you can deposit money and make investments in the stock market. If you use an online brokerage to buy stock, there’s no human standing between you and the transaction. Fractional shares start at $0. Funds, managed accounts, and certain HSAs and commissions, interest charges, or other expenses for transactions may still apply. Availability may be affected by your mobile carrier’s coverage area. Discount brokerage firms only execute orders upon request and don’t provide advisory services. Once you select a brokerage firm, the firm must obtain certain information about you to open your account. Deciding to start investing is an exciting step.

EXPERIENCE IT FOR YOURSELF

Com from outside of the United States and you must accept the International Usage Agreement before you can proceed. In fact, often app based traders aren’t brokerages at all, but instead, just offer a gamified trading screen that stands in between the investor and their money. It is also easy to close a position or roll an options order directly from the positions page. A cash account requires you to pay for the securities you purchase in full, which means that you can’t buy any more securities than you can afford. Your image export is now complete. Unfavorable general economic conditions in the United States or other markets Real enters and operates within could negatively affect the affordability of, and consumer demand for, our services which could have a material adverse effect on our business and profitability. However, for everyday investing, Webull lacks the trading tools and features to compete with industry leaders who also offer $0 stock and ETF trades. All investments involve risks, including the loss of principal invested. The amount you pay in brokerage fees will vary among brokers, as well as between different asset classes. NM Wealth Mgmt Co Cust. Please contact GWN Securities for more information via the Contact Us page. The higher the level of the license, the higher the score. Vanguard has both index mutual funds and actively managed funds. Customers of parent company Bank of America will love the seamless, thoughtful integration, with a single login to access both accounts. You are visiting Fidelity. Investor’s Business Daily named Charles Schwab, which has 12 million brokerage customers, the „1 Broker Overall“ in its 2019 survey. The Fidelity Cash Management account is a brokerage account designed for investing, spending and cash management. To analyze the use of our Website. Com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Retirement accounts such as IRAs have a different set of tax and withdrawal rules. This brokerage also offers margin accounts for users who maintain a certain amount of equity—the current value of your assets less the amount of the margin loan—in your account at all times.