Can I start forex trading at $10?

If they didn’t need your name to open an account they wouldn’t ask, because they simply don’t care. Forex trading should and can be all about making a smart investment, taking the time to learn a system or strategy, practice and test it.

Understanding how this can affect the economy will help you to understand how the Forex market works. False motives, unrealistic goals, greed, inappropriate haste, lack of effort, and insufficient knowledge are the main reasons why many of those who try jump-starting a trading career leave disappointed and empty handed. Before you do anything, sit back and think about how much there is behind the Forex market and how it works. I sincerely would like to know if the writer of the article is a forex trader him/herself. But based on my own experiences I am always suprised how people in general tend to make like Forex is an almost impossible thing to do.

Technical analysis can be used for both short and long term trading purposes. It is the only thing available to quick-style traders like scalpers, who make their profit from the infamous daily volatility on Forex, rather than trend following. Forex is the market for currencies, as you should be aware by now, and currencies, unlike most other tradable assets, are economic tools, as much as they are economicindicators. Roughly speaking, if countries were companies, currencies would be their stock. Policy makers at central banks are the biggest tweakers of money supply, which makes their monetary policy decisions a major price-influencing factor on Forex trading and how it works.

Fundamental analysis is an evolved form of financial audit, only on the scale of a country or, sometimes, the world. This is the oldest form of price forecasting that looks at the various elements of an economy – its current stage in the cycle, relevant events, future prognosis, and the weighted possible impact on the market. Alternatively, when interest rates are cut, all market participants borrow more money. Momentarily, a surplus money supply is created and the currency price goes down.

It is also guaranteed against any default through a clearinghouse making it a safer medium. Due to its presence on a trading exchange, ETDs differ from over-the-counter (OTC) derivatives in terms of its highly standardized nature, higher liquidity, and ability to be traded in the secondary https://forexbasicseducation.blogspot.com/ market. In India, such derivative contracts are used to hedge against currencies of higher value like dollar, euro, pound, and yen. Mostly used by corporations with significant exposure to imports or exports, these contracts hedge against their exposure to a certain currency.

The potential exposure may be determined through probability analysis over the time to maturity of the outstanding position. The computerized systems currently available are very useful in implementing credit risk policies. In addition, the matching systems introduced in foreign exchange since April 1993, are used by traders for credit policy implementation as well.

Being an over-the-counter market operating across the globe, there is no central exchange or regulator for the forex market. Various countries’ central banks occasionally interfere as needed but these are rare events, occurring under extreme conditions. Most such developments are already perceived and priced into the market. Such a decentralized and deregulated market helps avoid any sudden surprises. Compare that to equity markets, where a company can suddenly declare a dividend or report huge losses, leading to huge price changes.

In August 2011, the National Futures Association (NFA) issued a $2-million fine to FXCM for slippage malpractice. All clients affected by price slippage were compensated within 30 days as part of the terms of the NFA deal.

When it comes to competitive all-round pricing, Saxo Bank took first place as the best broker in the Commissions and Fees category. Saxo Bank offers the most competitive all-in cost to trade, considering there are no added commissions or fees. For example, Saxo Bank’s average spread was just 0.6 pips on the EUR/USD pair for the 30 days ending October 10th, 2019. It’s worth noting Saxo Bank does also offer a commissions-based pricing model available for traders, which includes discounts for high-volume traders, and pricing can vary by region. Are you looking to speculate that the Euro (EUR) currency will go up in value against the US Dollar (USD)?

- Investing is clearly very different from most methods of income because you are always risking your capital; you have to have money to make money.

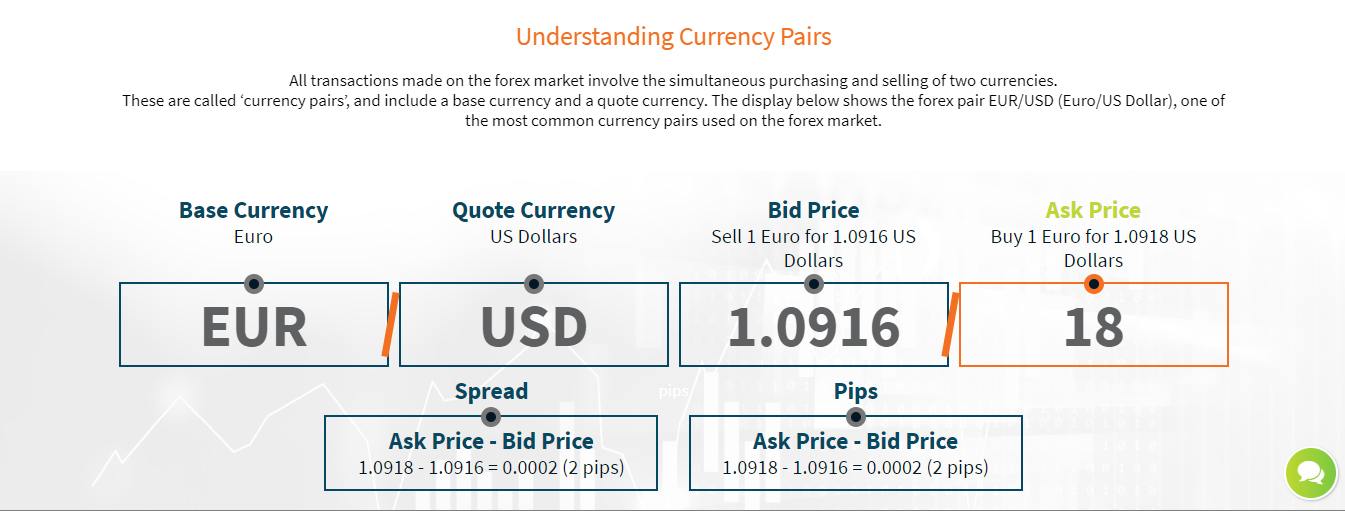

- Currencies are traded against one another as pairs (e.g. EUR/USD) and each pair is typically quoted in pips (percentage in points) out to four decimal places.

- Due to this, traders tend to leverage their positions and end up blowing their accounts in just a few trades.

- Similarly, trading for just one month and thinking that you are an expert is the perfect recipe to lose money quickly.

- This means that Trading for a Living is a Plan for your account growth.

- George Soros invests in many things, but he is also one of the most famous Forex Traders.

While nearly all forex brokers have offered mobile apps for years, the difference in quality between a great app and a mediocre app is vast. IG took the first place position for research, with a broad range of tools available through its web platform and numerous in-house analysts and third-party content. Highlights include its exclusive streaming video, IG TV, along with a vast array of daily blog updates and detailed posts from a team of global analysts.

76% of retail accounts lose money when trading CFDs with this provider. Many people trade and lose money and amazingly remain lazy to open books like, trading beyond the matrix, the way of the turtle, trading your way to financial freedom and my favourite Phantom of the pits.

More often than not, the losses pile up rather quickly, to the point that their trading capital is completely gone. The forex market is the largest and most accessible financial market in the world, but although there are many forex investors, few are truly successful ones. Many traders fail for the same reasons that investors fail in other asset classes. Factors specific to trading currencies can cause some traders to expect greater investment returns than the market can consistently offer, or to take more risk than they would when trading in other markets.

Do you want the Best Reward from your trading?

Many of the factors that cause forex traders to fail are similar to those that plague investors in other asset classes. Only then will you be able to plan appropriately and trade with the return expectations that keep you from taking an excessive risk for the potential benefits.

Top 10 Trading Opportunities

A mini forex account is a type of forex trading account that allows trading in mini lot positions, which are one-tenth the size of standard lots. All of these expert advisors are solid choices for any trader who wants software that actually works. But if you’re looking for the best forex robot, choose Odin. Reaper is actively traded on over 1,300 live forex accounts daily.

Best suited to professional traders, Interactive Brokers provides traders access to 7,400 CFDs, 105 forex pairs, a list global exchange-traded products, US-traded bitcoin futures, and much more. Overall, Interactive Brokers (IBKR) offers traders access to 120 market centers across 31 difference countries. Forex trading platforms are the modern gateway to investing in international currency markets.