What Are The Different Types Of Forex Trading Strategies?

Another significant change is the introduction of algorithmic trading, which may have lead to improvements to the functioning of forex trading, but also poses risks. We introduce people to the world of currency trading, and provide educational content to help them learn how to become profitable traders. We’re also a community of traders that support each other on our daily trading journey. If you can’t keep your emotions in check when trading, you will lose money. The most significant action that you can do to improve trading profits is to work on yourself.

What is the best Forex trading strategy?

Really knowing yourself and how you think can give you an edge that others in the market don’t have. My goal is to share practical advice to improve your forex psychology without boring you to death.

Day Trading and Scalping are both short-term trading strategies. However, remember that shorter term implies greater risk, so it is essential to ensure Dowmarkets effective risk management. With positional trading, you have to dedicate your time to analysing the market and predicting potential market moves.

Question: What is the Best Trading Strategy?

If you want a more in-depth guide to my Forex trading strategy you can check out Forex Mastermind. Price action doesn’t only adapt to changing market conditions though, it adapts to different pairs, different time frames and, crucially, to different traders. In this guide I will share my advanced Forex trading strategy with you.

e information for position traders due to the comprehensive view of the market. Entry and exit points can be judged using technical analysis as per the other strategies. As mentioned above, position trades have a long-term outlook (weeks, months or even years!) reserved for the more persevering trader. Understanding how economic factors affect markets or thorough technical predispositions, is essential in forecasting trade ideas.

Price action trading can be utilised over varying time periods (long, medium and short-term). The ability to use multiple time frames for analysis makes price action trading valued by many traders. Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies. Fortunately, several basic strategies exist to allow part-time traders to stay active and protect their positions even when they are away from their screens or even asleep.

We want you to be making your trading decisions based on confirmed entry points and be confident with each trade that you make. Here are three simple and very effective Forex trading strategies. The profit target is set at 50 pips, and thestop-loss order is placed anywhere between 5 and 10 pips above or below the 7am GMT candlestick, after its formation. After these conditions are set, it is now up to the market to take over the rest.

Remember the rules while currency trading, the stop loss, and risk management are critical to the success of a Professional Forex Trader. The Platinum methodology embraces the Institutional methods of trading.

- The beauty of Forex trading these days is as long as you have an internet connection and you have a laptop/computer or iPhone/iPad, you can literally trade from anywhere in the world.

- Traders who prefer short-term trades held for just minutes, or those who try to capture multiple price movements, would prefer scalping.

Hopefully, you can develop the mental edge you need to become the best trader you can be. When all charts point to a single direction and the current market sentiment is supported by the newswires, it’s easy to understand why many traders hesitate to go against the herd.

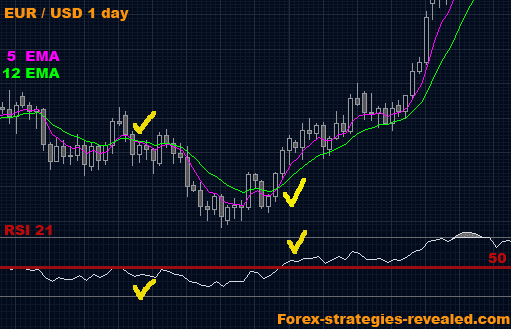

MACD Crossover Forex Trading Strategy-In A Trending Market, This System Can Make You hundreds of pips Easily

However, there is almost no time spent on the execution of your trading strategy. If you’re a savvy scalper, this https://dowmarkets.com/ process is usually far more frenetic. You will trade in and out of the Forex markets several times per day.

We educate our members who would like to become professional day traders or swing traders to think like Institutional Traders rather than Retail Traders. Trading in the same style will not only be profitable but also far less stressful for the retail trader.

Unless you’re a professional trader, you simply don’t have the manpower or time to keep your eyes always on the market. Although change can be good, changing a forex trading strategy too often can be costly.

Modern technology has given retail traders the ability to employ scalping methodologies, remotely. Many brokerage services offer low-latency market access options and software platforms with advanced functionality. Whether your forex scalping strategy is fully automated or discretionary, there is an opportunity to deploy it in the marketplace. Range trading is a simple and popular strategy based on the idea that prices can often hold within a steady and predictable range for a given period of time. That’s particularly evident in markets involving stable and predictable economies, and currencies that aren’t often subject to surprise news events.

The next group of Forex trading strategies on this Forex website areForex scalping strategies. You can use any of the free Forex trading strategies on this site and test them out. Yes, you can make money trading Forex…and its if you are a beginner trader and you get into Forex trading and start making money right away, you should be very careful to let ego overcome you. If you want to start online Forex trading in 2020 or just looking for bestForex trading strategies that work, then you’ve come to the right place.

The Story of Price

Traders should consider developing trading systems in programs like MetaTrader that make it easy to automate rule-following. In addition, these applications let traders backtest trading strategies to see how they would have performed in the past. Manual or automated tools are used to generate trading signals in forex trading strategies. The daily global average volume of forex trading was approximately $3 trillion as of 2017.